A Soda With Bite, Plus A Blog And A Book For Those With Sweet Teeth

We may receive a commission on purchases made from links.

One of the best things about travel is discovering new snacks and drinks that are uncommon here in the States. At a restaurant in Athens a few years ago, I ordered something called a Pimento, knowing only that "pimento" means "pepper" in Portuguese, and it turned out to be a light ginger ale-like beverage with a rush of chili on the back end—a drink truly after my own heart. Pimento was developed by a Parisian named Eric Dalsace, who, after deciding to give up alcohol, sought "something to replace the burn and intensity of a strong drink." After much experimentation, he settled on the combination of tonic with ginger, hot pepper, lime, bitter orange, gentian, and oregano. It's perfect for folks in Dalsace's position, or for anyone who loves ginger beer but tends to find many options on the market too sweet. Although I've never seen it here myself, Pimento's site says it does distribute Stateside. Maybe keep an eye out for it at World Market or your local specialty grocery.

Kookie House website

I first came across baking website Kookie House because of its proprietor, Molly Brodak, a poet and memoirist based out of Atlanta; I remember hearing good reviews of her book Bandit: A Daughter's Memoir when it came out last year. Turns out Brodak is also an extraordinary baker, and Kookie House is where she posts recipes, pictures, and her general thoughts on the craft of baking. (It's also where you can contact her to place an order should you be lucky enough to live in the Atlanta area.) Brodak comes up with wildly creative flavor combinations that this home cook and lapsed baker has never seen before and desperately wants to try: grilled grapefruit and brown sugar, chamomile lime, and hazelnut apricot.

I made her ridiculously simple vegan chocolate cake a few weeks ago, and it was utterly delicious. I did not even attempt to get as artistic with my frosting as she did in her gorgeous version pictured above, which is merely a hint at how lushly beautiful the site is as a whole. What's perhaps even more notable than how delicious these cakes (and danish and pavlova and brittle) sound, and how gorgeous Brodak's photography looks, is the accompanying writing. It's understated and graceful, unassuming and playful, which makes the site rather soothing and enjoyable to read—something I especially appreciate when so much writing on food blogs or in cookbooks can feel overly cute. And it's something I can enjoy even when I can't eat treats made by the chef herself.

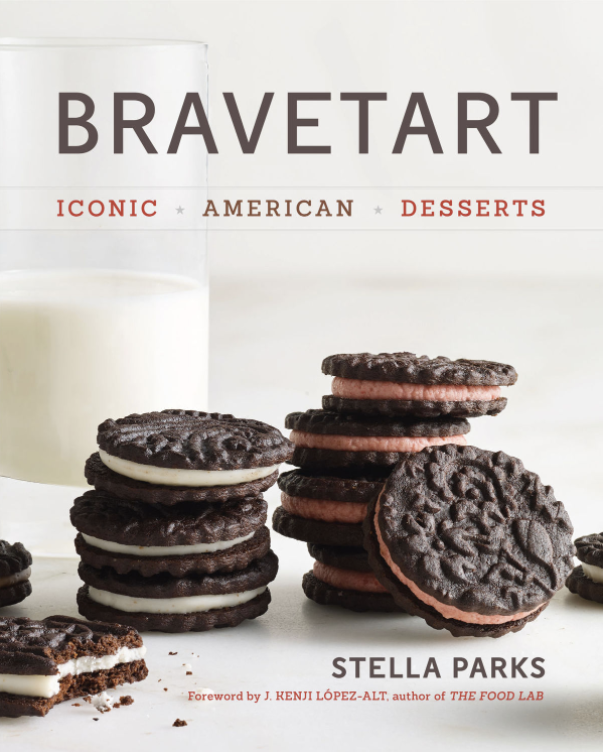

BraveTart: Iconic American Desserts by Stella Parks

"Devour immediately." This is the final instruction on many of Stella Parks' elegantly quirky recipes, and it encapsulates the spirit that her new release, BraveTart, brings to the table. While a good cookbook will provide context for each recipe, this Serious Eats veteran goes a loving extra mile, unraveling the history of each recipe's inception, and how each managed to capture the American imagination. As a result, you can have your cake and eat it, too: Learn the colorful history of the Oreo (not to mention its predecessor, the Hydrox) and then actually go make a batch of dead-ringer Oreos, for which the crowd goes wild. When you read BraveTart, the world of the everyday foods opens up to you. You learn that rolled oats are a genius and uniquely American creation, and that the cookie formerly known as a "chocolate jumble" now has the dreadfully expository name of "chocolate chip." Parks implores the reader to spatter this book with flour and butter as they attempt to bake the treasures within, because this is baking for the joy of it, not to master any one recipe but to simply experience it, to learn and to modify and to spend more giddy hours in the kitchen than we otherwise would. (And to see whether you can fool guests with a homemade Hostess cupcake.)